On Tuesday, MBP Intelligence offered some insights into what to expect from Budget 2025. Now that we've had the chance to fully digest the 493 page document, we have some key takeaways:

- MEREDITH: Budget gives us clearer picture of Carney's fiscal approach and Carneynomics

- BOESSENKOOL: A budget that relies on Carney’s personal credibility

- PHILLIPS: While Canadians live in the “micro,” Carney gives us a budget in the “macro”

- WOODFINDEN: Budget will need to demonstrate a return on investment to justify increased spending:

Get the latest MBP Intelligence briefings in your inbox:

No spam. Unsubscribe anytime.

MEREDITH: Budget gives us clearer picture of Carney's fiscal appaoach and Carneynomics

Three things stand out to me in this budget.

First, for a government that has been criticized in the past for ratcheting up expectations, they executed fairly well on the overall fiscal track. Thanks to some bad takes in advance that suggested the budget might hit $100 billion in 2025-26, the government was able to comfortably come in under that bar while still putting forward a plan that significantly increases the overall size of the deficit.

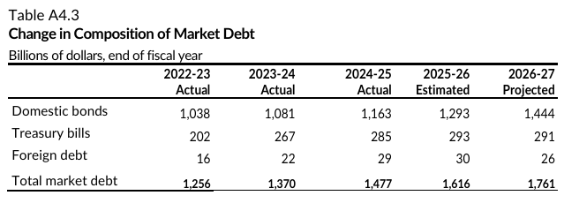

As I said going into the budget, I would be watching how the government positioned its debt management strategy in order to provide a cost-effective means to finance this new debt in an era where we face increased competition from everywhere for fixed income dollars. The overall market reaction was muted, with benchmark 10-year government of Canada bond yields moving barely 1 basis point between just before the document was tabled and the day after.

The debt management strategy itself is an interesting statement. It makes a noticeable shift of the debt structure toward the short and mid-points of the yield curve, particularly reducing exposure among ultra-short yields (under 1 year). To the extent that you shift debt allocation to where you think yields are likely to be the least expensive in the next year, this is the government implicitly signalling that they expect a flattening yield curve as short-term treasury bills either rise faster or 2 to 5 year bond notes fall. If it is the latter, this may be good news for mortgage borrowers - 5-year Canada bonds are often a benchmark indicator of mortgage pricing.

The vast majority of this new debt will also be bought by Canadians. It has traditionally been the case that Canadians themselves own most of our own debt, which reduces the risk of interest rate shocks. However, not all of it. And yet over the next two years Canada will add nearly $300 billion in market debt, 92% of which will be sourced as Canadian dollar domestic bonds. Do we have the demand and the capacity to absorb it all here? Does this assume we will be leaning more heavily on pension fund investors who are our deepest pools of capital to increase their exposure here? This will be very interesting to watch.

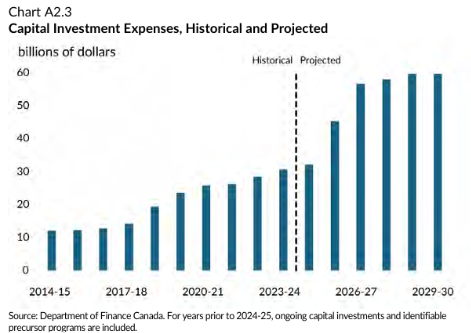

The third thing that stands out to me about this budget is the level of detail about the capital spending that has been included. (For a review of the new budgeting approach, see part 1 and part 2 of my three-part Carneynomics essay). Included in the document is a full annex on which spending components are included and counted, how the concept back-tests with previous fiscal cycles and what is changing with investments in this budget versus the current fiscal baseline. This level of fiscal transparency is to be applauded and should lend credibility to this very important part of Carneynomics.

This definition is important because it will be increasingly true for stakeholders that what gets counted as capital in a Mark Carney government is what will get both attention and money spent on it. For example, the recent push by some parts of the housing development industry to expand the definition of the GST relief on new homes bought by first-time homebuyers to all Canadians clearly does not count as a measure which directly builds supply. That may be its impact as a second or third order effect, but if it can’t be shown to have an immediate impact on supply and if it is meaningfully costly, then it will be hard to fit into the fiscal framework. There are bound to be many wide-ranging implications of this over the long-term.

While it is definitely true that Budget 2025 is a capital-heavy budget and Mark Carney is clearly a fan of this use of the federal spending power, it is evident from the data in the Budget that so was Justin Trudeau. And in fact, the biggest shift in federal spending toward the capital side of the ledger started with him in the first four budget years of his first mandate. Federal capital spending averaged about $12 billion in Harper’s majority mandate, which was then increased to nearly $31 billion under Trudeau by 2023-24. A $90 billion infrastructure plan was, people forget now, very much part of the then-Liberal leader’s call for why deficit spending made sense. And it was even endorsed by Larry Summers as a smart approach.

BOESSENKOOL: A budget that relies on Carney’s personal credibility

In my piece on earlier this week, I said I’d be watching for measures the budget would put in place to increase credibility, not just for today, but for tomorrow. I pointed to measures that Paul Martin put into his landmark 1995 federal budget as an example. Those measures included prudent economic forecasts, a contingency reserve, and moving to two-year budget forecasts.

I didn’t see any credibility-enhancing measures quite like those in this week’s budget. I can only conclude that Mark Carney is relying on his personal credibility instead. Which may not be a bad bet: it was arguably his personal credibility that put him over the line in the recent election.

But even if that works for today, how much credibility will this budget have one, two, or three years down the road? It may all work out, but if I were advising Mark Carney, I’d have bought a bit of credibility insurance in the form of specific measures in the budget. And they weren’t there.

If you’re inclined to be even more skeptical on this point, I would point you to a piece published by our friends in The Hub by Bill Robson of the C.D. Howe Institute, who made the lack of credibility in recent budgets the focus of his criticism of this budget.

Two other things caught my eye with this budget.

I was in the budget lock up for the 1995 budget. I’d recently written a shadow budget — the Taxpayers Budget — for the Reform Party that called for deep spending cuts, a balanced budget in three years, and massive reforms to federal-provincial transfers. I was responsible for the first draft of Preston Manning and the Reform Party’s response. I was just a kid, but I remember being very surprised at just how prescient the Taxpayers Budget was. And as a matter of historical record, Chretien/Martin did balance the budget three years later.

That was a transformative budget. Everyone knew it. Everyone saw it.

The budget this week was a break from the past. It was a Mark Carney Bay Street budget, not a Justin Trudeau Main Street budget. Mark Carney’s goals are economic, not social. Mark Carney’s tools are financial instruments, not new social programming. Those are very significant shifts in how the federal government operates. And they are shifts in the right direction.

But it’s not a transformative budget in the way the 1995 budget was.

I will register a caveat. My assessment of the transformative nature of the 1995 budget is largely a retrospective view. I don’t have that advantage with this budget. If in three years, trade is significantly diversified, private sector investment is way up, and productivity reverses its long-standing decline, I will happily eat my words. But writing today, I just don’t see it.

On the more positive side, the ambition and measures to reduce corporate taxes are both surprising and welcome. Of course, only a former Bank of Canada governor, or maybe Jack Mintz, would measure the success of tax measures by the marginal effective tax rate (METR) changes. But kidding aside, trying to get our METRs – the rate on the next dollar earned – below those of America is the right thing to do.

In conclusion, Mark Carney continues to rely on his personal and professional credibility and delivered a budget that is a significant break from the past. And he cut corporate taxes in a wonky enough way that it didn’t draw too much political attention. Not bad for a day's work.

PHILLIPS: While Canadians live in the “micro,” Carney gives us a budget in the “macro”

What this Budget is: a long-term macroeconomic strategy for Canada.

What this Budget isn’t: a document with an appreciation for the micro, and where it does have one, it does not have a corresponding parliamentary or communications strategy.

In other words, this is a document that derives almost entirely from the mind of the principal. The two areas I flagged where there’s potential political vulnerabilities – health care and young people - are not on the principal’s mind.

I often read federal Budgets from the perspective of the provinces. Here, I will flag two areas of looming conflict: immigration levels and industrial carbon pricing.

The industrial pricing section of the Budget hasn’t attracted much attention yet, but it is a far more explicit declaration of federal jurisdiction and appetite for conflict than I was expecting. The Budget pledged to act promptly and transparently to impose sectoral price benchmarks in cases where provinces weaken or eliminate theirs, and Alberta and Saskatchewan have respectively already done so.

As I have been saying for months, Canada has a principal that understands industrial carbon pricing, offset markets, and climate finance at a level unmatched anywhere else in the world, so firms are advised to level-up their sophistication in how Output-Based Allocations work in their sector and even in other sectors that may produce credits.

Market signals, and real regulatory oversight, are going to be set out in the next decade. And contracts-for-difference, a national offset market, and the advantage that industrial pricing confers on some market players will make industrial pricing difficult to untangle if there is a change in government. There’s significant upside for many Canadian firms, from extraction to processing, but only if they fully understand the policy development process for OBAs and how the review periods and tightening rates affect individual product categories.

On immigration, the dramatic drop in temporary residents and new intake of Permanent Residents will most certainly influence overall demand in the economy and will absolutely cause some labour shortages in select provinces, regions or subsectors of the economy. There appears to be little appetite for a conversation with the provinces about expansion of the Provincial Nominee Program. Lower-wage sectors will likely see the effects in a matter of months, and it remains to be seen whether these shortages will translate into more labour force participation for the 18-24 age cohort. Whenever there are labour shortages in lower-wage sectors, we also see upward pressure on minimum wage policies, and provincial governments who have not addressed the issue in almost a decade (ie Alberta) may now be forced to do so.

In sum:

- If you’re a defence contractor or a large construction firm, there is opportunity now in this Budget.

- If you’re a member of a Building Trades union, there’s a lot to like here.

- If you’re a proponent of old-school industrial policy – Buy Canadian policies or sectoral supports to Canadian industries, for example – there’s a lot to be positive about in this Budget.

- If you’re a fan of Trudeau-era social policies, you’re not much fussed about this Budget, as it preserves transfers to individuals and provinces.

- If you’re interested in Canadian media and culture funding, you will be over the moon about this document.

- If you’re looking for specific pocketbook policies, you will be disappointed.

- If you are looking for the Government of Canada’s commitment to conservation, parks and nature, you’re likely to be more than disappointed. You may be furious.

- If you’re looking for a Budget that seeks to make friends – in order to get itself passed through Parliament or with the provinces – this Budget is not interested in making friends. It is concerned with macroeconomic fundamentals. Which is fine if you’re running a central bank, but politics is about process, connection, and relationships.

WOODFINDEN: Budget will need to demonstrate a return on investment to justify increased spending

The budget was, as I thought it might be in my Tuesday write up, a “smorgasbord” of announcements and items. So in response, I’m going to offer a smorgasbord of thoughts. I don’t envy the PMO comms team who will have to find a way to try and clearly communicate everything, because it’s hard to get a core message across when there are so many different pieces in a single document.

- This is a macroeconomic budget, which will please pundits, wonks and investors. If those investors actually take up the government’s call and we start seeing growth in private and business investment, then it will have been worth it. But there’s a massive risk to a budget like this, and one I suspect the Opposition will seize on. Ordinary people don’t live in the macro, they live in the micro. Ordinary people are not going to see the impacts of this budget, and especially for the large section of the population who live in economic precarity or struggle with cost-of-living challenges, this is going to be a tough sell.

- Aside from some relatively modest measures like reviewing bank fees, automatic filing for low-income Canadians and some boosts to youth job programs and training, there was very little in here that directly addresses affordability. Again, this was a budget about the macro and not the micro. Whether that is what this country needs or not, it presents political risks.

- The most disappointing and remarkably unambitious part of this budget was what it offered on housing. I won’t spend long on this, because I think Mike Moffatt has already said what needs to be said on the substance, but this is a perplexing choice for me. I am an almost complete subscriber to the “housing theory of everything,” and if we want to fix our productivity and investment challenges, we need to fix housing. The scale of what this budget offers on this, and especially because it does not even live up to what was promised in the Liberal election platform, is perplexing and again something the opposition should seize on.

- One of the most notable things about this budget was the language and rhetoric it used around immigration. The budget explicitly links uncontrolled population growth (almost exclusively through immigration) with increasing pressures on housing, healthcare and the labour market. A few years ago, it would have been hard to make this case publicly without being called nasty names, and now it’s in the Liberal budget. Explicitly talking about “taking back control” of immigration was also an interesting rhetorical choice. Either way, if you think about where both public and elite conservation were on this topic a few years ago, we’ve come a long way.

- As usual with a budget, much of the discussion is around the debt and deficit numbers. My colleagues will defend these numbers as both “meeting the moment” and sustainable given our fiscal position relative to other G7 countries. There’s plenty of time to have this debate, but I’ll add one thought I’ve not seen expressed elsewhere. Part of the offer on display in this budget is that we need to “invest more” to kickstart our sclerotic economy. But this means we need to see a return on investment. Given the increasing economic uncertainty, there is risk attached in continuing to run large deficits especially if things turn south. Canadians will need to see a return on this investment to justify it. That may not be decided tomorrow or even in the immediate future, but at some point the political and economic bill will come due.

- Given the change in the timing of the budget, which Tyler discussed extensively in Carneynomics Part Two, I think it’s fair to see this budget as the first part of a budget that will be followed up by an actual mini budget in a Spring Economic Statement. Things in the Liberal platform missing from this Budget could well show up there.